Long-term investing made simple

We don't help you get rich tomorrow. We help you find the investments that meet your investment goals and risk tolerance based on decades of academic research.

Everything you need to invest with confidence

Reach your financial goals and build an investment portofolio that suits your criteria and risk tolerance.

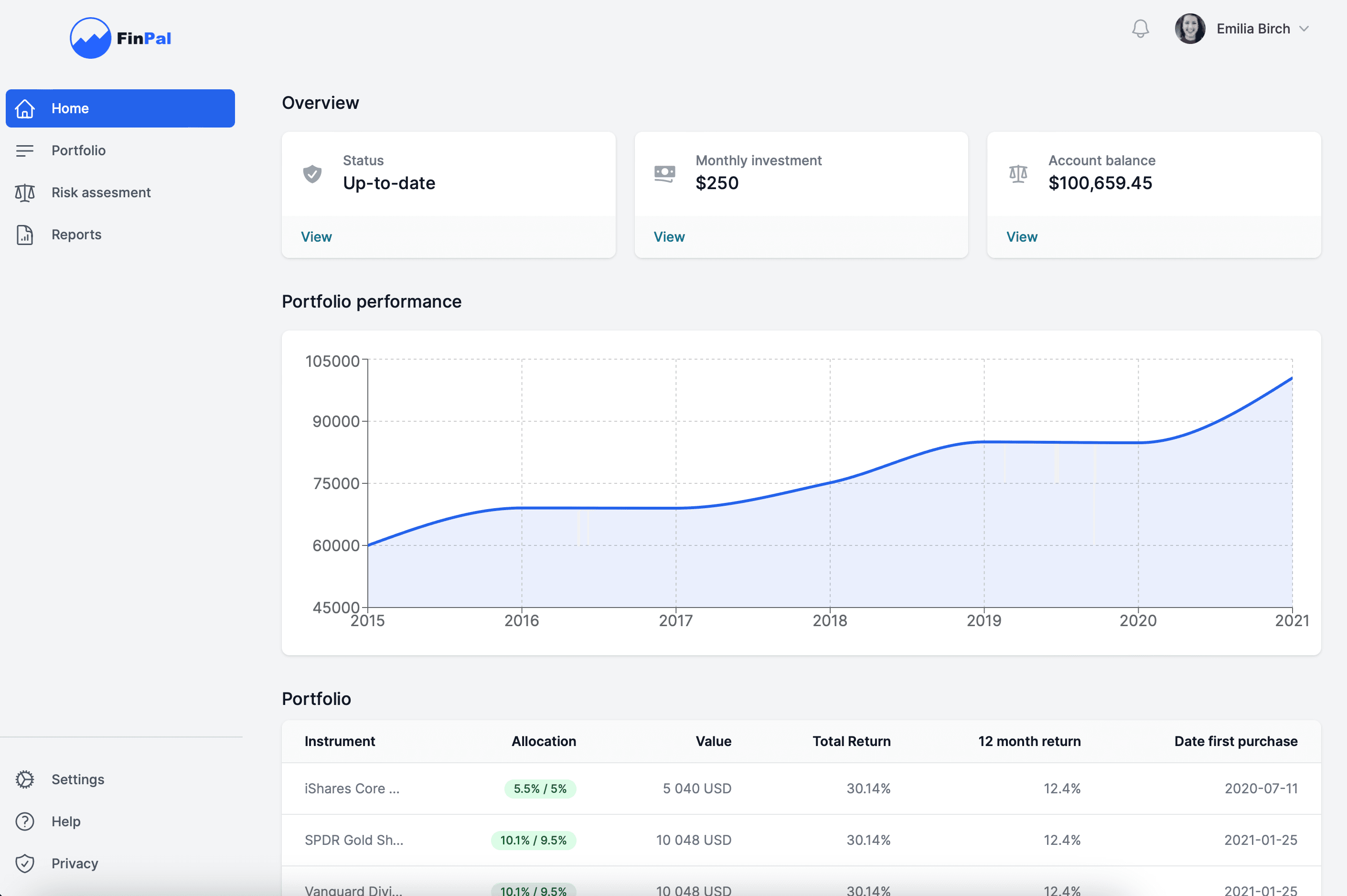

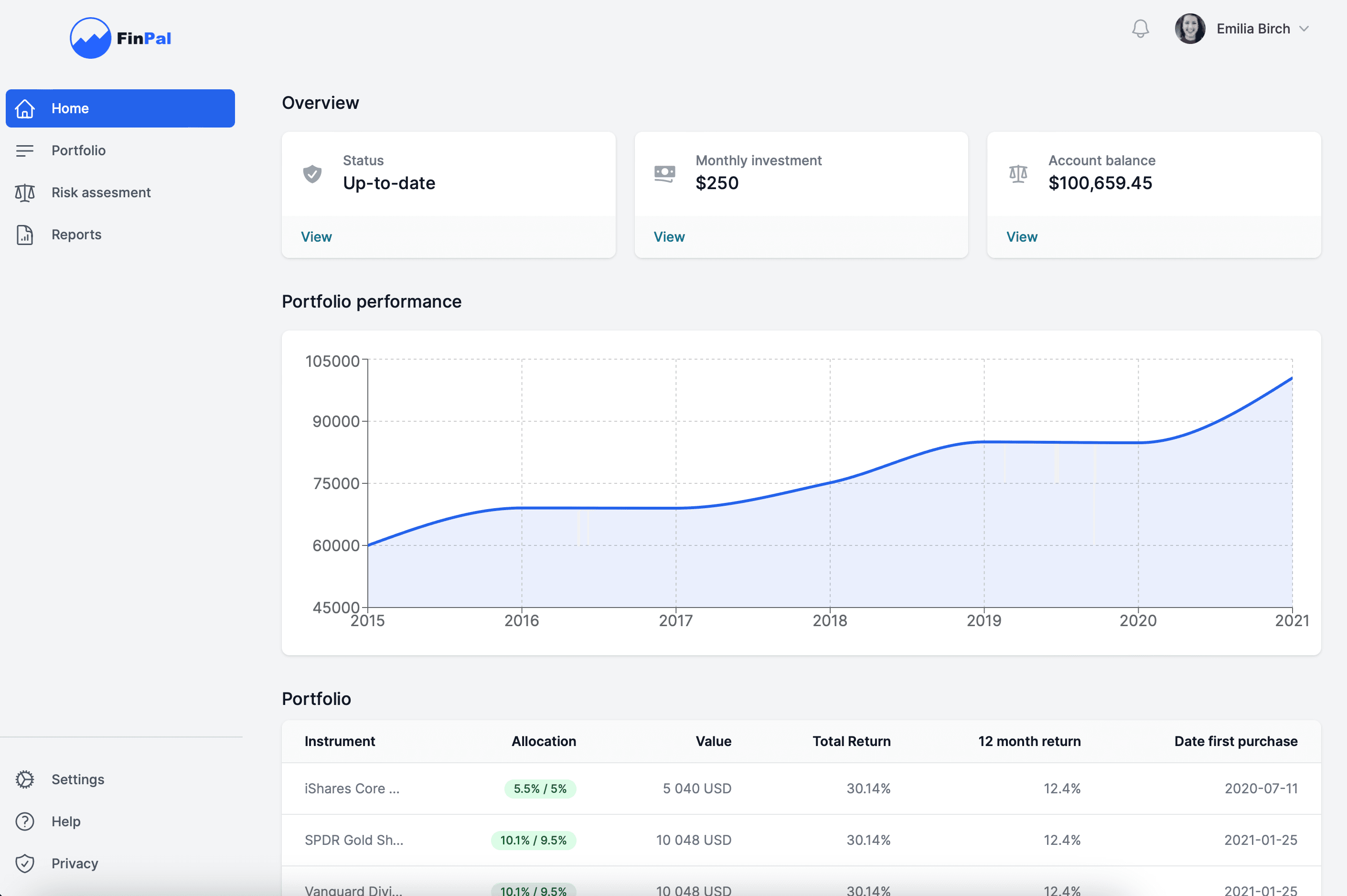

Your personalised investment portfolio

We determine your risk tolerance and build your personalised portfolio in line with your goals.

Reach your financial goals

Wether your saving for retirement or a new car, we find the investment portfolio that best fits your goals and risk tolerance

Save time

You don't need to read the Wall Street Journal. We'll keep you up to date and inform you when it's best to adjust your portfolio.

Transparent

We don't help you get rich quickly, we help you make sound financial decision to help you reach your long-term goals.

Become your own financial advisor

Our models use knowledge derived from decades of academic research to help you reach your financial goals. We'll tell you which funds to buy or sell, and when to do it.

Decisions

Reach your financial goals.

We help you make a balanced decision between your risk tolerance and the return you need to realise your investment goals. Our model maximizes returns given your risk tolerance and investment goals.

Updates

Buy at the right time.

We'll inform you when its time to make adjustments to your investment portfolio such that you can realize your long-term goals. You don't need to read the Wall Street Journal, nor worry. Worrying and focussing on the short-term only leads to overttrading, which is a common pitfall.

Best practices

Build upon decades of academic research.

We help you apply investment best practices such as diversificaiton, dollar-cost averaging, long-term planning, rebalancing, a strong focus on management costs, and more. We've done the research such that you don't have to.

Reach your financial goals.

We help you make a balanced decision between your risk tolerance and the return you need to realise your investment goals. Our model maximizes returns given your risk tolerance and investment goals.

Buy at the right time.

We'll inform you when its time to make adjustments to your investment portfolio such that you can realize your long-term goals. You don't need to read the Wall Street Journal, nor worry. Worrying and focussing on the short-term only leads to overttrading, which is a common pitfall.

Build upon decades of academic research.

We help you apply investment best practices such as diversificaiton, dollar-cost averaging, long-term planning, rebalancing, a strong focus on management costs, and more. We've done the research such that you don't have to.

We help you realise your long-term financial goals

We help you invest with confidence. These are some of the features that help you invest in the funds that are right for you.

Personalised risk assessment

Our risk assesment is revolutionary and gives you an accurate risk tolerance score.

Rebalancing

We send you updates if you're portoflio needs adjusting. You can relax in the meantime.

Diversification

Our results take investment best practices such as diversification and a strong focus on management cost in to account.

Optimal portfolio theory

We determine in which funds to invest based on modern efficient portfolio theory.

1000+ assets

We analyse over 1000+ funds to find the best fit for you.

Low fees

We only include funds that are highly rated, and charge Minimal fees.

Investment criteria

Exclude industries in which you don't want to invest such as tobacco or big oil.

Financial goals

We take your goals into account, whether your saving for retirement, a house, rainy day or your dream car

Get started today

It’s time to let your money work for you. Start using our tools to build your invesment portfolio.

Join the waiting listSimple pricing, for everyone

It doesn’t matter what size your business is, our software won’t work well for you.

Bronze

The essentials perfect to help you started.

$75 /year

- Access to portfolio models

- Personal risk assessment

- 5 portfolio simulations

- 100 tracked funds

Silver

For if you want more and want to stay up to date automatically.

$150 /year

- Access to portfolio models

- Personal risk assessment

- 25 portfolio simulations

- 500 tracked funds

- Quarterly updates

- Rebalancing updates

Gold

Get an hour of consultation with our team to help you get started and stay up to date automatically.

$500 /year

- Access to portfolio models

- Personal risk assessment

- 50 portfolio simulations

- 1000 tracked funds

- Quarterly updates

- Rebalancing updates

- 1 hour of free personalized consulation

Frequently asked questions

If you can’t find what you’re looking for, email our support team.

Can I buy or sell funds on FinPal?

No, we tell you which funds to buy or sell to realise your financial goals. You need a broker (such as Interactive Brokers, eToro, Charles Schwab, Lynks or DeGiro) to actually buy and sell the funds.

Do you offer a white-label solution?

Absolutely, send us an e-mail and ask for corporate solutions.

How do I apply for a job at FinPal?

We only hire our customers, so subscribe for a minimum of 6 months and then let’s talk.

How do you select the funds covered by the analysis?

We use a few rules to select funds. First, funds should have Morning Start rating of 4 or higher. Second, funds should have cost below 50bp per year.

On what acadamic research are your models based?

Our model is heavily inspired by the work of nobel price laureate Markowitz. We do not have any association with Markowitz, we just use his research.

Will the free plan, be free forever?

No, we will eventually charge for the free plan. We will give you a heads up before we do so.

Are you offering financial advice?

No, we do not offer personal financial advice. Nor should you interpret the results of FinPal as personal advice. We do not recommend buying or selling stocks in any way. Investing in financial markets is risky and if you do, it's your risk to face. Investing is at your risk. You can lose all your money doing so.

Do you get paid by any of the funds listed?

No, we only make money from selling subscription. We are not paid by funds in any way.